Below, I conduct a business model breakdown and a post-mortem review of an investment that the fund recently exited. Boot Barn is a U.S. specialty retailer focused on western and work wear with 400+ stores in 45 states. Since its 2014 IPO at $16 per share, Boot Barn recently became a so-called tenbagger stock, surpassing share prices of $160 in H2/24. The 10x in share price was driven by a tenfold increase in its EBIT from ~$20m in FY14 to ~$200m in FY24. Despite its success as a public company, Boot Barn sees no shortage of critics and the post below explains why market participants were divided into two camps in 2024 regarding the company's mid-term prospects

Company History and Boot Barn’s Post-COVID AUV Puzzle

BOOT is primarily a footwear retailer generating ~1/2 of its sales from selling western and work boots, with the remainder coming from apparel and accessories. BOOT’s management often describes its customers as the people who “feed America, build America, and protect America”.

As the largest western and workwear retailer in the U.S., one might assume that BOOT’s roots lie in Texas or the Midwest, but the first Boot Barn store was opened in 1978 in Huntington Beach, California by Ken Meany. In the following decades, Ken increased the store count by ~1 p.a. and BOOT finished 2007 with 32 stores in three western states. In 2007, Ken was looking to retire, so he brought in BOOT’s first outside investor in the form of PE firm Marwit Capital from Newport Beach, California. Thereafter, the Meany family retained a sizable stake in BOOT and Ken’s son Patrick was installed as the firm’s new CEO. Marwit valued BOOT at less than $50m in 2007 and thus the deal was closed at around 1/100th of today’s equity value.

Under Marwit’s ownership, BOOT raised its organic store opening rate to 3 p.a. and began rolling up the western apparel industry via M&A. It closed three deals, including the acquisition of several Corral West and Western Warehouse stores from failing retailer BTWW. These deals increased the store count to 85 in eight states by 2011, up from 32 when Marwit took its stake in 2007. 2011 marked the next milestone year for BOOT as Marwit exited its investment and sold its stake to another PE firm, Freeman Spogli, based in Los Angeles, California. Over Marwit’s four-year holding period, BOOT grew its sales by +166% and its EBITDA by +250%.

Freeman Spogli continued on Marwit’s path and increased BOOT’s store count through a mix of organic growth and M&A. In 2012, BOOT acquired regional chain RCC Western Stores (29 stores, predominantly in South and North Dakota) and the same year, Patrick Meany was succeeded by BOOT’s long-term CEO Jim Conroy, who recently left the firm after a 12-year tenure. Jim left BOOT to become the next CEO of discount apparel retailer Ross Stores (ROST:US), beginning in February 2025. In 2013, BOOT acquired Houston-based western retailer Baskins (30 stores, predominantly in Texas and Louisiana) which was instrumental for BOOT’s expansion outside its core states in the west. Post-closing, BOOT operated 147 stores in 23 states including Arizona, California, Colorado, Florida, Georgia, Idaho, Indiana, Illinois, Iowa, Louisiana, Minnesota, Montana, Nevada, New Mexico, North Carolina, North Dakota, Oregon, South Dakota, Tennessee, Texas, Utah, Wisconsin and Wyoming. Over time, all acquired stores were rebranded to Boot Barn. The acquisitions of RCC Western Stores and Baskins brought the number of relevant footwear and apparel chains focused on the western lifestyle down to three by 2015 (see below).

Boot Barn’s Last Sizable Acquisition: Sheplers

In 2015, BOOT acquired the last major western competitor that was up for grabs, Sheplers, which had 25 stores and a large e-commerce segment, thanks to the company’s roots in the mail order catalog business. BOOT bought Sheplers for $147m from PE firm Gryphon Investors based in San Francisco, California. Over its eight-year holding period, Gryphon realized a 2.9x ROI and sold Sheplers with $157m in TTM revenue and $15m in adj. EBITDA. BOOT expected $6-8m in synergies from the deal and with $66m in acquired Sheplers e-commerce sales, BOOT’s e-commerce penetration temporarily jumped from 4% to 15% (vs. around 10% today).

Family-run western chain Cavender’s remains the only sought-after M&A target in the industry. As of today, Cavender’s is one-quarter the size of BOOT, operating 100+ stores in 14 states (thereof 63 in Texas, 10 in Louisiana). The company’s founders, James and Pat Cavender, passed away in 2018/19, but their sons Joe, Mike and Clay continue the family’s legacy and are unlikely to sell the family business (the three sons are shown below with Texas governor Greg Abott).

In 2014, Freeman Spogli planned its exit after a 3-year holding period. Having conducted 8 organic store openings and 2 sizable acquisitions (RCC and Baskins with a combined 59 stores), Freeman Spogli had increased BOOT’s store count to 152, up from 85 and prepared the company for an IPO. On October 30, 2014, BOOT went public at $16 per share and generated net proceeds of $83m. Freeman Spogli as well as Ken Meany sold all of their shares over the following two years and today, there remains no large BOOT shareholder worth calling out.

Since becoming a public company, BOOT has positioned itself as an organic growth story due to the lack of relevant available M&A targets. It grew its store count organically from 152 stores in FY14 to 345 stores in FY23 and to 400 stores in FY24 (10YR unit CAGR: +10%).

In addition to opening more doors, BOOT has a long history of generating positive same-store sales (SSS). In its early days, BOOT grew SSS by an average of +6.6% p.a. from FY03 to FY15. From FY16 to FY21, BOOT grew SSS at a more modest average of +3.1% per year and AUV increased from $2.3m to $2.6m. At this rate, BOOT should have reached $2.9m AUV in FY24 but instead it reached $3.7m AUV in FY24 (a +28% diversion from its historical trendline). In FY25, current consensus estimates imply $3.7m AUV again. I have illustrated BOOT’s overachievement compared to its historical trendline in the chart below.

The major deviation occurred in FY22. BOOT’s fiscal year ends in March, so FY21 was BOOT’s last business year unaffected by COVID-19 (There was one single month in FY21 affected by the pandemic: March 2020). FY22 mostly corresponds to calendar year 2021, and during that year, BOOT posted a massive expectation beat, reporting an unprecedented SSS gain of +57.2%. These much higher sales per comparable store drove AUV to skyrocket from $2.6m pre-COVID to $4.2m immediately after. Looking at the chart above, some readers might wonder if AUV shouldn’t be up a lot solely due to the recent high inflation period in the U.S. However, a closer look at footwear and apparel prices in the U.S. reveals that, unlike many other PCE categories, apparel and footwear did not become significantly more expensive than before the pandemic. As a matter of fact, apparel prices for urban U.S. consumers are lower than they were in 1995 (see graph below).

The same doesn’t quite apply to footwear prices which have increased slightly (+5%) in the U.S. over the past five years. However, this increase significantly lags the overall CPI growth.

Taking the bigger picture into account, we can reasonably assume that BOOT’s AUV did not benefit from significant ticket inflation in boots and apparel. Therefore, the question remains:

”If not high inflation, what caused the abnormal +57.2% SSS gain in FY22 that pushed AUV into uncharted territories?”

New Segment, Broadened Assortment, and Share Gains from Temporarily Closed Single-Store Competitors Drove Influx of New Boot Barn Customers in 2021

BOOT’s roots lie in serving a core (1) Western customer, which is a person working or living on a ranch. This customer archetype rides horses, listens to country music, goes to rodeos and wears cowboy hats. From this traditional segment, BOOT expanded into (2) Workwear, which primarily includes safety and work boots for blue-collar workers in the fields of oil & gas, agriculture, electrical or construction. Sales in these two segments are mostly functional in nature. However, BOOT later added a third smaller (3) Fashion segment (Wonderwest) which comprises more discretionary, contemporary boots and dresses for women. In Western and Work, BOOT sees a domestic TAM of ~$20B. In what it considers an adjacent Country lifestyle segment, it sees an additional $15B in addressable footwear and apparel sales. Thus, in 2019/20, BOOT added (4) Country as its fourth segment to Western, Work and Fashion.

“Historically, Boot Barn had focused heavily on the Western customer, and lead with our signature category of boots. We were then and continue to be the leading player serving us quite sizable market. Approximately four years ago, we embarked on a three-pronged strategy to expand our addressable market, which included the following components. First, we sought to expand the brand's reach. We focused intently on growing the work segment, as well as adding new segments, including the more fashion-forward Wonderwest category and more recently just Country, which encapsulates a much larger share of the US population. This expansion strategy has introduced new customers for market segments that are not too far removed from Boot Barn's core Western customer. We also shifted our media mix to marketing channels intended to broadcast to a larger population such as television, radio and digital to drive awareness of Boot Barn. We believe this work contributed to expanding the customer reach of Boot Barn, as evidenced by our continuous growth in customers on a comp store basis over this period of time.

The second piece of the strategy was to contemporize the Boot Barn brand. We made transformative changes to the creative esthetic of our brand and our marketing communications. We shifted the focus away from product and price promotion and focus exclusively on building the strength of the Boot Barn brand, so would resonate with both its legacy Western customers, as well as the broader cross-section of the population that we were seeking to add that may have some affinity for our merchandise, but don't identify as purely a western lifestyle customer. We broadened our merchandise assortment remodeled many stores and upgraded in-store merchandising significantly. Today, we have successfully transformed from what many thought, with simply a footwear retailer to a true lifestyle brand. Upgrading and modernizing the brand has played a critical role and enabling us to become more relevant to more customers that are immediately adjacent to our original core customer that may have been unlikely to shop in a pure western retail store.

As for the final piece of the strategy, in order to ensure that we would be relevant to all of our customers both existing and new, we created an extremely well-defined customer segmentation strategy. We speak to our more than 4 million active customers with e-mail, direct mail, and digital communications, that are tailored to them based on their demographics in purchase history. This enables us to speak to each customer group and their language and with relevant merchandise offerings. This was a critical piece of the puzzle, as we needed to ensure we were not at risk of alienating our core Western customer in our desire to expand the addressable market. Fortunately, we have successfully achieved both objectives, adding new customers, while remaining highly relevant to our original Western customer.”

- Jim Conroy, recently departed CEO, in August 2021 (Q1/22 Earnings Call)

BOOT thinks of its new Country customer as someone who lives a casual outdoor lifestyle. Unlike its Western customer, the Country customer doesn’t ride horses or work with cattle, but may enjoy riding a motorcycle or spending time outdoors with his dogs. He wears baseball caps instead of cowboy hats and T-shirts instead of woven shirts. As an example for the differences in both segments’ merchandise, consider a woven long sleeve shirt designed for a Western customer: This shirt has longer sleeves and cuffs to allow handling a rope while riding a horse and moving cattle. The Country customer doesn’t need this type of garment and also won’t participate in a rodeo. What he might do instead is attend the local football game or watch a NASCAR race. BOOT planned to appeal to this customer segment in calendar year 2020 with a new marketing aesthetic and more diverse SKUs on the floor space, hoping to drive additional traffic into its stores (see below).

From calendar year 2020 to calendar year 2022, BOOT started adding 40%+ of gross dollar inventory per comparable store. The majority of this increase was an investment in the breadth of the assortment as BOOT began stocking hiking boots and other outdoor apparel. 50% of the new Country inventory is footwear, such as Merrell or KEEN hiking boots, similar to the mix in BOOT’s other segments. One can see the impact of the additional goods in the stores in the diagram below.

As BOOT started ramping up the Country segment in 2020, most of its mom-and-pop Western competitors were not allowed to stay open during the peak of the pandemic. In contrast, BOOT was designated as an essential retailer due to its sizable workwear sales. With many competitors closed, new customers came in, experienced the new Country assortment and recognized that BOOT was no longer carrying only Western and Work wear:

“I would go all the way back to April 2020 was sort of the first decision that we took was to stay open and be there for our customer as an essential retailer. And we were able to do that because we carried a fair amount of work boots and flame-resistant work apparel for the oil industry et cetera. And that decision enabled us to not only take care of our current customers, keep the stores' teams in place, the store managers, et cetera. But candidly most of our competition is mom and pop western only retailers. So, those guys for the most part closed down during the beginning of the pandemic and we were able to take care of not only our customers but certainly picked up share from those players as competitors.

I'd say the second thing is we have continually for the last three or four years expressed our desire to expand the brand's reach and it could be as simple as looking at some of our marketing materials from five years ago versus today. Five years ago, we were squarely focused on a rancher, western customer and each successive year we've expanded the aperture a bit to be more inclusive. The Just Country initiative was part of that and that came at a perfect time when customers from all sorts of retail channels and some mainstream retailers were looking to dress more casually. And we had what we call casual western product but hit a pretty broad swath of the US population.”

- Jim Conroy, recently departed CEO, October 2021 (Q2/22 earnings call)

The introduction of the Country segment and the broadened assortment coincided with a population that dressed more casually after the shelter-in-place orders and had a heightened interest in being outdoors. BOOT saw an influx of new customers in calendar year 2020 but more so in 2021, which explains a large part of its 57.2% FY22 SSS increase.

One can try to separate how much of the SSS increase was caused by new customers using the following math. BOOT stores have no traffic entrance counters but the chain runs a loyalty program (B Rewarded), which accounts for 2/3 of its sales. With B Rewarded, most sales can be attributed to individual repeat customers who earn a 6% discount for every $250 spent.

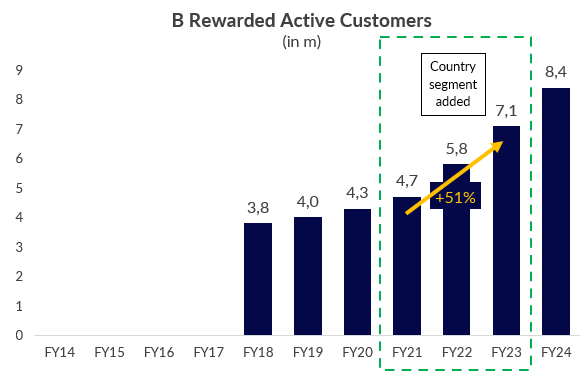

To gauge the traffic development per comp store driven by the influx of new customers, one can compare how much faster the B Rewarded Active customer count grew vs. unit growth.

From FY21-23, active B Rewarded Customers grew 51%, while BOOT’s store count grew 26%. Per comp store that leaves an active customer base >20% larger than pre-pandemic. Especially in FY22, growth of active B Rewarded customers (+23.4%) outstripped unit growth (+9.9%).

Since many first-time customers in FY22 won’t have signed up for BOOT’s loyalty program immediately, and with the average basket being up only MSD in FY22, it’s fair to assume that about half of the 57.2% SSS increase in FY22 as well as half of the 61.0% growth in AUV from $2.6m to $4.2m came from new customers.

That still leaves us with another 28.6PP of the SSS increase to be explained by a change in repeat customer behavior. This increase comes from established customers shopping more frequently at a BOOT store in FY22 (see quote from management below).

“The balance, if there's no real help for us in terms of inflation and basket size, that's been pretty de minimis. So the balance is our legacy customers shopping more frequently and undoubtedly expanding their wallet and shopping different parts of the store.”

- Jim Conroy, recently departed CEO, May 2022 (Q4/22 earnings call)

In sum, one can explain BOOT’s extraordinary FY22 SSS gain with the following four steps:

Naturally, it didn’t take long after market participants had dissected the reasons for the SSS jump before they turned their attention to an obvious follow-up question:

“How many of the new customers were here to stay and how quickly, if at all, would long-time customers revert back to their historical purchase pattern?”

[end of asbtract]

…

The full marketing document is available online here* (*by clicking the link, you confirm your status as a QUALIFIED INVESTOR).

If you don’t want to miss anything, you can follow me on Twitter: patient_capital

To learn more about the investment fund I advise or access my previous annual letters to investors you can visit: https://www.patient-capital.de/fonds

This document is for informational purposes only. It is no investment advice and no financial analysis. The Imprint applies.