Investor Letter for the calendar year 2021

How the payments technology company VISA could grow by a factor of 5x by 2030

Investor Letter for the calendar year 2021

Introduction

Dear fellow investors,

Thank you very much for taking the time to read my investor letter for the calendar year 2021. I have been advising the Patient Capital Fund for Hamburg-based fund boutique Covesto Asset Management since January 1st, 2020. The development of the fund price during the years 2018/19, which you can see on some financial platforms, has to be assigned to the former advisors.

Once a year I would like to report to you the considerations which were important in advising the fund during the calendar year, whether new significant investments were made, how the portfolio structure and performance at year-end turned out and, at the end, devote myself to one topic in detail.

This year’s topic in detail is how the payments technology company VISA could grow by a factor of 5x by 2030.

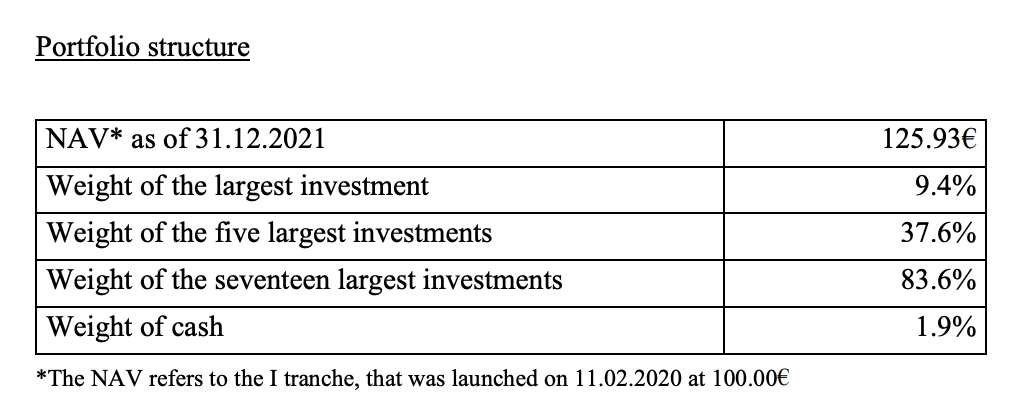

The investor letter begins with a table showing the portfolio structure and a performance overview.

Portfolio structure

My investment strategy for the Patient Capital Fund focuses on low trading activity with a very high concentration in the best investment ideas. The largest positions in the fund are regularly weighted near the maximum regulatory limit of 10% of the fund volume, the top 5 positions often make up ~40% of the fund volume (2021: 37.6%) and the top 17 positions represent >80% of total assets (2021: 83.6%).

On the next page I would like to inform you about the ten largest holdings of the fund.

Alphabetical listing of the ten largest holdings of Covesto Patient Capital

Alphabet

Amazon

CCL Industries

Fomento Económico Mexicano

Frontier Digital Ventures

Mastercard

Microsoft

S&P Global

Spotify

VISA

In the past calendar year, I did not recommend a new company to be included in the top 10. All of the fund's ten largest holdings were already part of the portfolio in the previous year and movements are primarily due to price changes.

Performance overview

The table shows the performance of the fund since I started advising it. In my Investor Letter for the 2020 calendar year I explain why such a table provides little information about the skills of a fund advisor in the short run. Only in the long run will it become clear whether a fund advisor creates repeatable value-add for his investors with a previously defined strategy. After showing the fund performance in the table above, I don’t intend to address it too much and instead have a more detailed interim result discussion in January 2025 (after five full calendar years of performance). My goal remains to achieve a performance of >10% p. a. on average for your as well as my investment in the fund over the long run.

How the payments technology company VISA could grow by a factor of 5x by 2030

To achieve a performance of >10% p. a., the largest holding of the Covesto Patient Capital fund, the payments technology company VISA (2021: 9.4% of NAV), is expected to make a significant contribution. Outside of China, VISA operates the largest credit and debit card network in the world with a market share of 60% and a lead of 1.8x over its closest rival Mastercard. There are 3.7 billion VISA cards in circulation worldwide making them the most accepted payment method on the planet, which can be used at 80+ million merchants. VisaNet is the heart of the payments technology company based in San Francisco and enables authorization requests and clearing and settlement between a cardholder's bank (issuer) and a merchant's commercial bank (merchant acquirer). More than 15,000 participating banks use VisaNet to conduct transactions with one another without the need for bilateral contracts.

VisaNet was originally introduced by Bank of America as a closed loop system under the brand "BankAmericard" and has built up strong network effects since it was opened to third-party banks more than 60 years ago. On one side of the network there are consumers who ask for a VISA card from their bank because, unlike national debit cards (e.g. Girocard in Germany), they can use it internationally to pay at most retailers. If you were only allowed to take a single means of payment with you on a trip around the world, the VISA card would certainly win the race. On the other side of the network, more and more merchants are accepting VISA cards, as over 1 billion people prefer to pay with them and sometimes even no longer carry cash as an alternative. Payment networks which are trying to enter brick-and-mortar retail, and start without network effects built up over decades, are regularly destined to fail, as their retailer and consumer penetration cannot reach an efficient scale compared to the market leader. VISA as the leading network processed 165 billion transactions in the past fiscal year (>5,000 transactions per second) with a payment volume of $10.4 tn (Ø-receipt: $63), a net revenue yield of 0.23% (based on net revenues of $24.1 bn) and an operating margin of 66% (EBIT of $16.0 bn). The company has an outstanding track record in expanding the card business and has increased its payments volume by more than a factor of 10x every 20 years (1975: $0.01 tn, 1995: $0.60 tn, 2021: $10.4 tn).

…

The full PDF is available online here* (*by clicking the link, you confirm your status as a QUALIFIED INVESTOR) and QUALIFIED INVESTORS resident or domiciled in Germany can subscribe for full articles here.

This document is for informational purposes only. It is no investment advice and no financial analysis. The Imprint applies.